You may be eligible to claim a reduced membership subscription for 2025 if you are not retired and have:

- an income less than £30,840 for the 12 months ended 31 December 2024, or

- started or expect to start parental leave in 2024 or 2025, or

- are receiving UK means tested benefits

How to claim

Complete the relevant form for your membership class based on where you are resident as of 1 January 2025:

United Kingdom/Republic of Ireland

- Fellow, Chartered or Legal member

- Associate, Legal Associate or Licentiate member

- Affiliate or Student member

Outside United Kingdom/Republic of Ireland

Affiliate and Student members overseas are currently charged the lowest rate available to members with a concession and therefore no reductions are available to affiliate or student members overseas.

If you pay by Direct Debit and wish to discuss a concession please contact the Membership team. To set up a Direct Debit please click here.

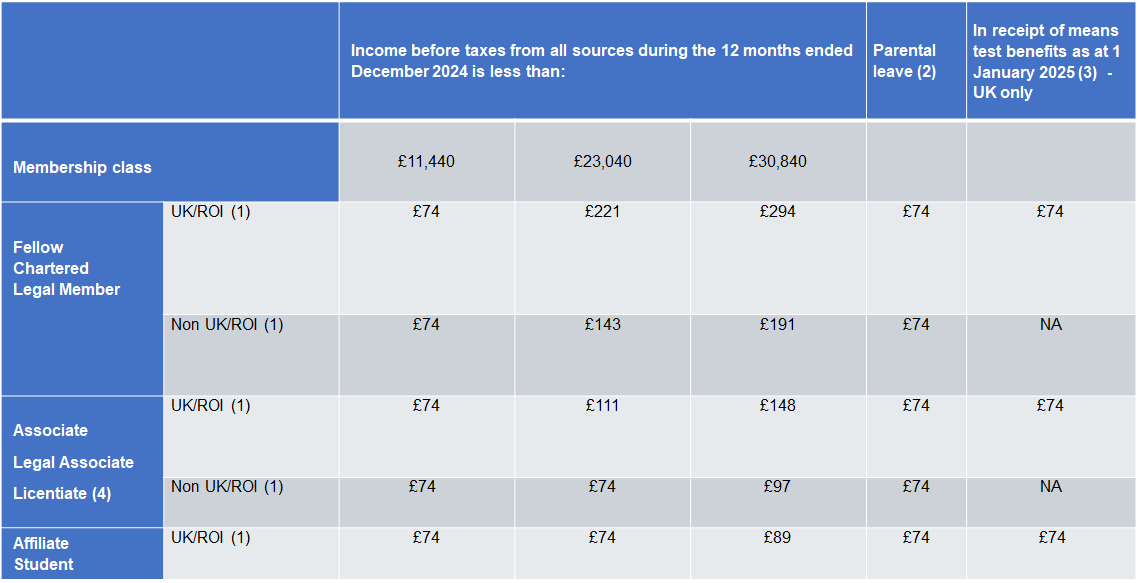

Reduced subscription rates

1. UK/ROI: rates apply to members resident within the United Kingdom, Republic of Ireland, the Isle of Man and the Channel Islands

2. Parental leave: applies if you are a parent and are taking leave as a primary carer in in 2024 or 2025 but cannot be claimed for the same pregnancy or adoption twice.

3. UK means test benefits: include Income Support, Jobseekers Allowance, Employment Support, Pension Credit, Universal Credit and Housing Benefit.

4. Licentiate members: only full paying Licentiates, i.e. those paying the £185 or £121 rate, are eligible to apply for a reduced subscription fee.

Financial hardship

If you are experiencing financial hardship and would like further advice please contact the Membership team.